Page 78 - FINAL CFA SLIDES DECEMBER 2018 DAY 4

P. 78

Session Unit 3:

13. Technical Analysis

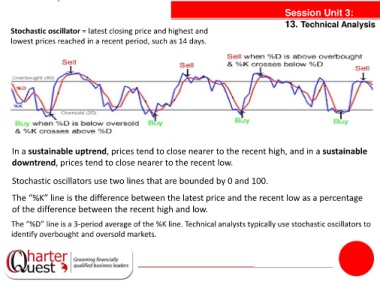

Stochastic oscillator = latest closing price and highest and

lowest prices reached in a recent period, such as 14 days.

In a sustainable uptrend, prices tend to close nearer to the recent high, and in a sustainable

downtrend, prices tend to close nearer to the recent low.

Stochastic oscillators use two lines that are bounded by 0 and 100.

The “%K” line is the difference between the latest price and the recent low as a percentage

of the difference between the recent high and low.

The “%D” line is a 3-period average of the %K line. Technical analysts typically use stochastic oscillators to

identify overbought and oversold markets.