Page 8 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 8

Session Unit 13:

44. Market Structure & organisation

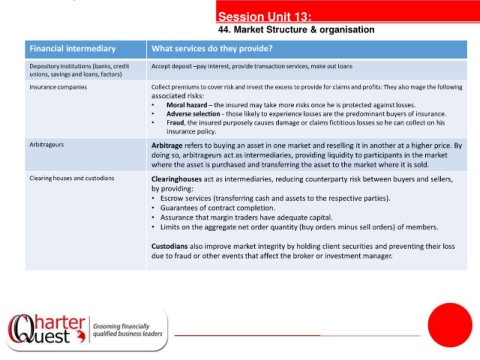

Financial intermediary What services do they provide?

Depository institutions (banks, credit Accept deposit –pay interest, provide transaction services, make out loans

unions, savings and loans, factors)

Insurance companies Collect premiums to cover risk and invest the excess to provide for claims and profits: They also mage the following

associated risks:

• Moral hazard – the insured may take more risks once he is protected against losses.

• Adverse selection - those likely to experience losses are the predominant buyers of insurance.

• Fraud, the insured purposely causes damage or claims fictitious losses so he can collect on his

insurance policy.

tanties

Arbitrageurs Arbitrage refers to buying an asset in one market and reselling it in another at a higher price. By

doing so, arbitrageurs act as intermediaries, providing liquidity to participants in the market

where the asset is purchased and transferring the asset to the market where it is sold.

Clearing houses and custodians Clearinghouses act as intermediaries, reducing counterparty risk between buyers and sellers,

by providing:

• Escrow services (transferring cash and assets to the respective parties).

• Guarantees of contract completion.

• Assurance that margin traders have adequate capital.

• Limits on the aggregate net order quantity (buy orders minus sell orders) of members.

Custodians also improve market integrity by holding client securities and preventing their loss

due to fraud or other events that affect the broker or investment manager.