Page 13 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 13

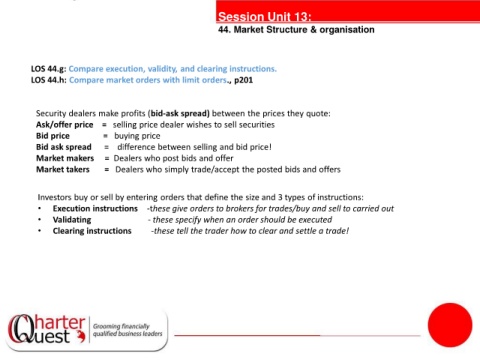

Session Unit 13:

44. Market Structure & organisation

LOS 44.g: Compare execution, validity, and clearing instructions.

LOS 44.h: Compare market orders with limit orders., p201

Security dealers make profits (bid-ask spread) between the prices they quote:

Ask/offer price = selling price dealer wishes to sell securities

Bid price = buying price

tanties

Bid ask spread = difference between selling and bid price!

Market makers = Dealers who post bids and offer

Market takers = Dealers who simply trade/accept the posted bids and offers

Investors buy or sell by entering orders that define the size and 3 types of instructions:

• Execution instructions -these give orders to brokers for trades/buy and sell to carried out

• Validating - these specify when an order should be executed

• Clearing instructions -these tell the trader how to clear and settle a trade!