Page 14 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 14

Session Unit 13:

44. Market Structure & organisation

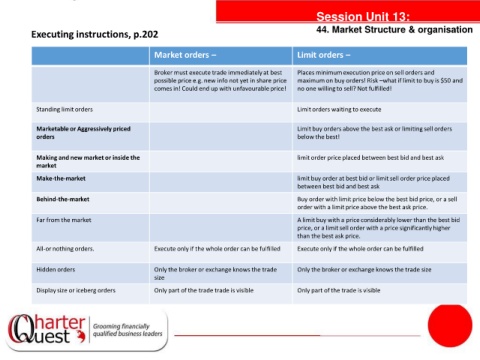

Executing instructions, p.202

Market orders – Limit orders –

Broker must execute trade immediately at best Places minimum execution price on sell orders and

possible price e.g. new info not yet in share price maximum on buy orders! Risk –what if limit to buy is $50 and

comes in! Could end up with unfavourable price! no one willing to sell? Not fulfilled!

Standing limit orders Limit orders waiting to execute

Marketable or Aggressively priced Limit buy orders above the best ask or limiting sell orders

orders below the best!

tanties

Making and new market or inside the limit order price placed between best bid and best ask

market

Make-the-market limit buy order at best bid or limit sell order price placed

between best bid and best ask

Behind-the-market Buy order with limit price below the best bid price, or a sell

order with a limit price above the best ask price.

Far from the market A limit buy with a price considerably lower than the best bid

price, or a limit sell order with a price significantly higher

than the best ask price.

All-or nothing orders. Execute only if the whole order can be fulfilled Execute only if the whole order can be fulfilled

Hidden orders Only the broker or exchange knows the trade Only the broker or exchange knows the trade size

size

Display size or iceberg orders Only part of the trade trade is visible Only part of the trade is visible