Page 16 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 16

Session Unit 13:

44. Market Structure & organisation

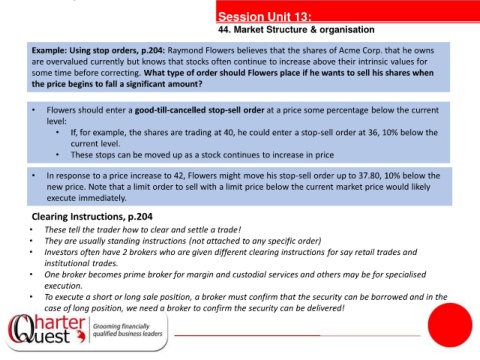

Example: Using stop orders, p.204: Raymond Flowers believes that the shares of Acme Corp. that he owns

are overvalued currently but knows that stocks often continue to increase above their intrinsic values for

some time before correcting. What type of order should Flowers place if he wants to sell his shares when

the price begins to fall a significant amount?

• Flowers should enter a good-till-cancelled stop-sell order at a price some percentage below the current

level:

• If, for example, the shares are trading at 40, he could enter a stop-sell order at 36, 10% below the

current level.

tanties

• These stops can be moved up as a stock continues to increase in price

• In response to a price increase to 42, Flowers might move his stop-sell order up to 37.80, 10% below the

new price. Note that a limit order to sell with a limit price below the current market price would likely

execute immediately.

Clearing Instructions, p.204

• These tell the trader how to clear and settle a trade!

• They are usually standing instructions (not attached to any specific order)

• Investors often have 2 brokers who are given different clearing instructions for say retail trades and

institutional trades.

• One broker becomes prime broker for margin and custodial services and others may be for specialised

execution.

• To execute a short or long sale position, a broker must confirm that the security can be borrowed and in the

case of long position, we need a broker to confirm the security can be delivered!