Page 19 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 19

Session Unit 13:

44. Market Structure & organisation

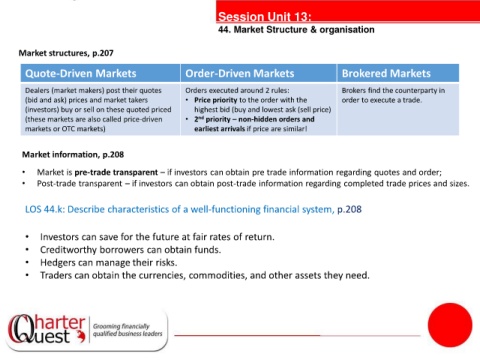

Market structures, p.207

Quote-Driven Markets Order-Driven Markets Brokered Markets

Dealers (market makers) post their quotes Orders executed around 2 rules: Brokers find the counterparty in

(bid and ask) prices and market takers • Price priority to the order with the order to execute a trade.

(investors) buy or sell on these quoted priced highest bid (buy and lowest ask (sell price)

(these markets are also called price-driven • 2 priority – non-hidden orders and

nd

markets or OTC markets) earliest arrivals if price are similar!

tanties

Market information, p.208

• Market is pre-trade transparent – if investors can obtain pre trade information regarding quotes and order;

• Post-trade transparent – if investors can obtain post-trade information regarding completed trade prices and sizes.

LOS 44.k: Describe characteristics of a well-functioning financial system, p.208

• Investors can save for the future at fair rates of return.

• Creditworthy borrowers can obtain funds.

• Hedgers can manage their risks.

• Traders can obtain the currencies, commodities, and other assets they need.