Page 19 - Test 1 Slides - 2. Donation Tax

P. 19

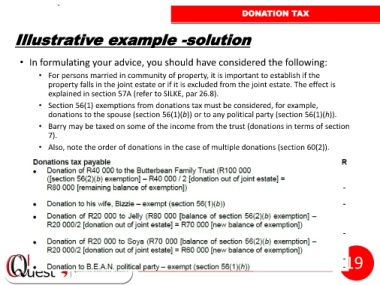

DONATION TAX

Illustrative example -solution

• In formulating your advice, you should have considered the following:

• For persons married in community of property, it is important to establish if the

property falls in the joint estate or if it is excluded from the joint estate. The effect is

explained in section 57A (refer to SILKE, par 26.8).

• Section 56(1) exemptions from donations tax must be considered, for example,

donations to the spouse (section 56(1)(b)) or to any political party (section 56(1)(h)).

• Barry may be taxed on some of the income from the trust (donations in terms of section

7).

• Also, note the order of donations in the case of multiple donations (section 60(2)).

19