Page 20 - Test 1 Slides - 2. Donation Tax

P. 20

DONATION TAX

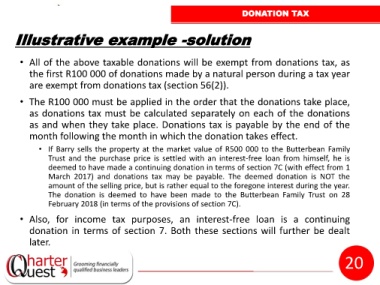

Illustrative example -solution

• All of the above taxable donations will be exempt from donations tax, as

the first R100 000 of donations made by a natural person during a tax year

are exempt from donations tax (section 56(2)).

• The R100 000 must be applied in the order that the donations take place,

as donations tax must be calculated separately on each of the donations

as and when they take place. Donations tax is payable by the end of the

month following the month in which the donation takes effect.

• If Barry sells the property at the market value of R500 000 to the Butterbean Family

Trust and the purchase price is settled with an interest-free loan from himself, he is

deemed to have made a continuing donation in terms of section 7C (with effect from 1

March 2017) and donations tax may be payable. The deemed donation is NOT the

amount of the selling price, but is rather equal to the foregone interest during the year.

The donation is deemed to have been made to the Butterbean Family Trust on 28

February 2018 (in terms of the provisions of section 7C).

• Also, for income tax purposes, an interest-free loan is a continuing

donation in terms of section 7. Both these sections will further be dealt

later.

20