Page 204 - SBR Integrated Workbook STUDENT S18-J19

P. 204

Chapter 13

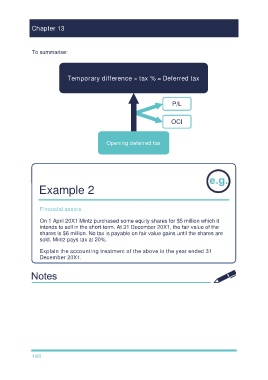

To summarise:

Temporary difference × tax % = Deferred tax

P/L

OCI

Opening deferred tax

Example 2

Financial assets

On 1 April 20X1 Mintz purchased some equity shares for $5 million which it

intends to sell in the short-term. At 31 December 20X1, the fair value of the

shares is $6 million. No tax is payable on fair value gains until the shares are

sold. Mintz pays tax at 20%.

Explain the accounting treatment of the above in the year ended 31

December 20X1.

198