Page 206 - SBR Integrated Workbook STUDENT S18-J19

P. 206

Chapter 13

3.2 Share option schemes

Share option schemes are recognised as an expense in profit or loss over the vesting

period. Tax relief is not usually granted until the exercise date.

This delayed tax relief is a deductible temporary difference.

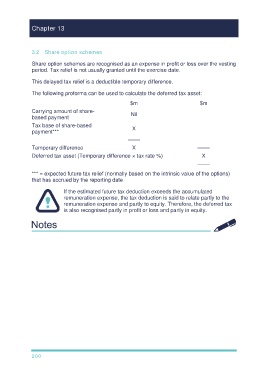

The following proforma can be used to calculate the deferred tax asset:

$m $m

Carrying amount of share- Nil

based payment

Tax base of share-based X

payment***

––––

Temporary difference X ––––

Deferred tax asset (Temporary difference × tax rate %) X

––––

*** = expected future tax relief (normally based on the intrinsic value of the options)

that has accrued by the reporting date

If the estimated future tax deduction exceeds the accumulated

remuneration expense, the tax deduction is said to relate partly to the

remuneration expense and partly to equity. Therefore, the deferred tax

is also recognised partly in profit or loss and partly in equity.

200