Page 340 - SBR Integrated Workbook STUDENT S18-J19

P. 340

Chapter 21

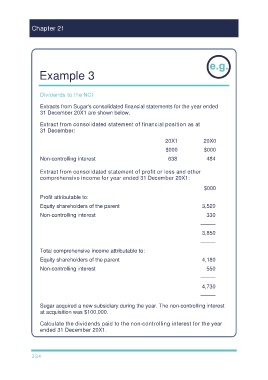

Example 3

Dividends to the NCI

Extracts from Sugar's consolidated financial statements for the year ended

31 December 20X1 are shown below.

Extract from consolidated statement of financial position as at

31 December:

20X1 20X0

$000 $000

Non-controlling interest 638 484

Extract from consolidated statement of profit or loss and other

comprehensive income for year ended 31 December 20X1:

$000

Profit attributable to:

Equity shareholders of the parent 3,520

Non-controlling interest 330

–––––

3,850

–––––

Total comprehensive income attributable to:

Equity shareholders of the parent 4,180

Non-controlling interest 550

–––––

4,730

–––––

Sugar acquired a new subsidiary during the year. The non-controlling interest

at acquisition was $100,000.

Calculate the dividends paid to the non-controlling interest for the year

ended 31 December 20X1.

334