Page 436 - SBR Integrated Workbook STUDENT S18-J19

P. 436

Chapter 25

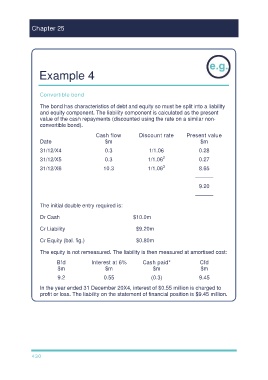

Example 4

Convertible bond

The bond has characteristics of debt and equity so must be split into a liability

and equity component. The liability component is calculated as the present

value of the cash repayments (discounted using the rate on a similar non-

convertible bond).

Cash flow Discount rate Present value

Date $m $m

31/12/X4 0.3 1/1.06 0.28

31/12/X5 0.3 1/1.06 2 0.27

31/12/X6 10.3 1/1.06 3 8.65

––––––

9.20

––––––

The initial double entry required is:

Dr Cash $10.0m

Cr Liability $9.20m

Cr Equity (bal. fig.) $0.80m

The equity is not remeasured. The liability is then measured at amortised cost:

Bfd Interest at 6% Cash paid* Cfd

$m $m $m $m

9.2 0.55 (0.3) 9.45

In the year ended 31 December 20X4, interest of $0.55 million is charged to

profit or loss. The liability on the statement of financial position is $9.45 million.

430