Page 490 - SBR Integrated Workbook STUDENT S18-J19

P. 490

Chapter 25

Example 2

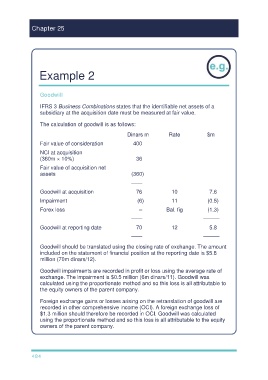

Goodwill

IFRS 3 Business Combinations states that the identifiable net assets of a

subsidiary at the acquisition date must be measured at fair value.

The calculation of goodwill is as follows:

Dinars m Rate $m

Fair value of consideration 400

NCI at acquisition

(360m × 10%) 36

Fair value of acquisition net

assets (360)

——

Goodwill at acquisition 76 10 7.6

Impairment (6) 11 (0.5)

Forex loss – Bal. fig (1.3)

—— ———

Goodwill at reporting date 70 12 5.8

—— ———

Goodwill should be translated using the closing rate of exchange. The amount

included on the statement of financial position at the reporting date is $5.8

million (70m dinars/12).

Goodwill impairments are recorded in profit or loss using the average rate of

exchange. The impairment is $0.5 million (6m dinars/11). Goodwill was

calculated using the proportionate method and so this loss is all attributable to

the equity owners of the parent company.

Foreign exchange gains or losses arising on the retranslation of goodwill are

recorded in other comprehensive income (OCI). A foreign exchange loss of

$1.3 million should therefore be recorded in OCI. Goodwill was calculated

using the proportionate method and so this loss is all attributable to the equity

owners of the parent company.

484