Page 104 - Microsoft Word - 00 P1 IW Prelims.docx

P. 104

Chapter 6

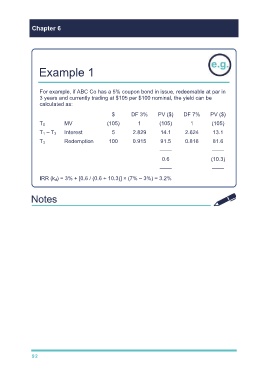

Example 1

For example, if ABC Co has a 5% coupon bond in issue, redeemable at par in

3 years and currently trading at $105 per $100 nominal, the yield can be

calculated as:

$ DF 3% PV ($) DF 7% PV ($)

MV (105) 1 (105) 1 (105)

T 0

T 1 – T 3 Interest 5 2.829 14.1 2.624 13.1

T 3 Redemption 100 0.915 91.5 0.816 81.6

–––– ––––

0.6 (10.3)

–––– ––––

IRR (k d) = 3% + [0.6 / (0.6 + 10.3)] × (7% – 3%) = 3.2%

92