Page 105 - Microsoft Word - 00 P1 IW Prelims.docx

P. 105

The weighted average cost of capital (WACC)

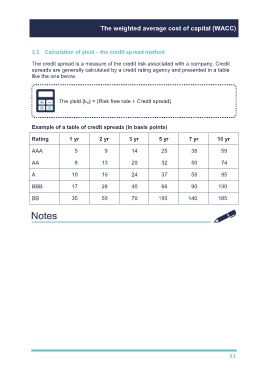

3.3 Calculation of yield – the credit spread method

The credit spread is a measure of the credit risk associated with a company. Credit

spreads are generally calculated by a credit rating agency and presented in a table

like the one below.

The yield (k d) = (Risk free rate + Credit spread)

Example of a table of credit spreads (in basis points)

Rating 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr

AAA 5 9 14 25 38 59

AA 8 13 20 32 50 74

A 10 16 24 37 58 95

BBB 17 28 40 66 90 130

BB 35 50 70 100 140 185

93