Page 55 - Microsoft Word - 00 P1 IW Prelims.docx

P. 55

International operations and international investment appraisal

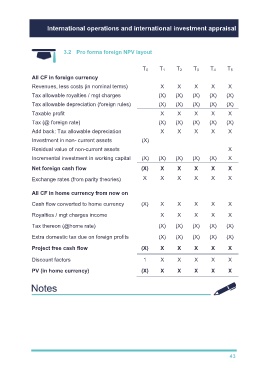

3.2 Pro forma foreign NPV layout

T 0 T 1 T 2 T 3 T 4 T 5

All CF in foreign currency

Revenues, less costs (in nominal terms) X X X X X

Tax allowable royalties / mgt charges (X) (X) (X) (X) (X)

Tax allowable depreciation (foreign rules) (X) (X) (X) (X) (X)

Taxable profit X X X X X

Tax (@ foreign rate) (X) (X) (X) (X) (X)

Add back: Tax allowable depreciation X X X X X

Investment in non- current assets (X)

Residual value of non-current assets X

Incremental investment in working capital (X) (X) (X) (X) (X) X

Net foreign cash flow (X) X X X X X

Exchange rates (from parity theories) X X X X X X

All CF in home currency from now on

Cash flow converted to home currency (X) X X X X X

Royalties / mgt charges income X X X X X

Tax thereon (@home rate) (X) (X) (X) (X) (X)

Extra domestic tax due on foreign profits (X) (X) (X) (X) (X)

Project free cash flow (X) X X X X X

Discount factors 1 X X X X X

PV (in home currency) (X) X X X X X

43