Page 10 - Taxation Test 4 Slides - Individuals

P. 10

INDIVIDUALS & RING FENCING

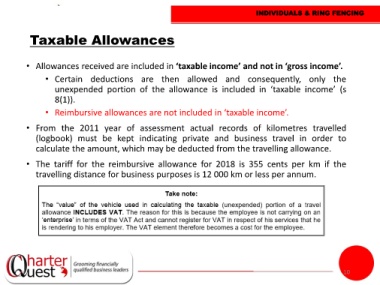

Taxable Allowances

• Allowances received are included in ‘taxable income’ and not in ‘gross income’.

• Certain deductions are then allowed and consequently, only the

unexpended portion of the allowance is included in ‘taxable income’ (s

8(1)).

• Reimbursive allowances are not included in ‘taxable income’.

• From the 2011 year of assessment actual records of kilometres travelled

(logbook) must be kept indicating private and business travel in order to

calculate the amount, which may be deducted from the travelling allowance.

• The tariff for the reimbursive allowance for 2018 is 355 cents per km if the

travelling distance for business purposes is 12 000 km or less per annum.

10