Page 15 - Taxation Test 4 Slides - Individuals

P. 15

INDIVIDUALS & RING FENCING

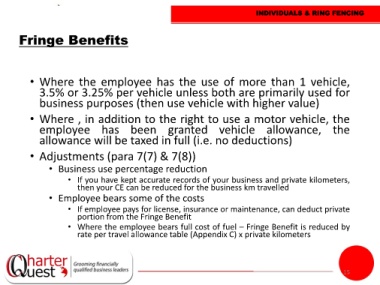

Fringe Benefits

• Where the employee has the use of more than 1 vehicle,

3.5% or 3.25% per vehicle unless both are primarily used for

business purposes (then use vehicle with higher value)

• Where , in addition to the right to use a motor vehicle, the

employee has been granted vehicle allowance, the

allowance will be taxed in full (i.e. no deductions)

• Adjustments (para 7(7) & 7(8))

• Business use percentage reduction

• If you have kept accurate records of your business and private kilometers,

then your CE can be reduced for the business km travelled

• Employee bears some of the costs

• If employee pays for license, insurance or maintenance, can deduct private

portion from the Fringe Benefit

• Where the employee bears full cost of fuel – Fringe Benefit is reduced by

rate per travel allowance table (Appendix C) x private kilometers

15