Page 18 - Taxation Test 4 Slides - Individuals

P. 18

INDIVIDUALS & RING FENCING

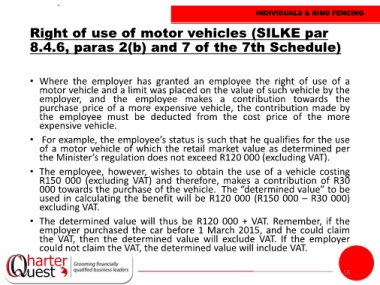

Right of use of motor vehicles (SILKE par

8.4.6, paras 2(b) and 7 of the 7th Schedule)

• Where the employer has granted an employee the right of use of a

motor vehicle and a limit was placed on the value of such vehicle by the

employer, and the employee makes a contribution towards the

purchase price of a more expensive vehicle, the contribution made by

the employee must be deducted from the cost price of the more

expensive vehicle.

• For example, the employee’s status is such that he qualifies for the use

of a motor vehicle of which the retail market value as determined per

the Minister’s regulation does not exceed R120 000 (excluding VAT).

• The employee, however, wishes to obtain the use of a vehicle costing

R150 000 (excluding VAT) and therefore, makes a contribution of R30

000 towards the purchase of the vehicle. The “determined value” to be

used in calculating the benefit will be R120 000 (R150 000 – R30 000)

excluding VAT.

• The determined value will thus be R120 000 + VAT. Remember, if the

employer purchased the car before 1 March 2015, and he could claim

the VAT, then the determined value will exclude VAT. If the employer

could not claim the VAT, the determined value will include VAT.

18