Page 19 - Taxation Test 4 Slides - Individuals

P. 19

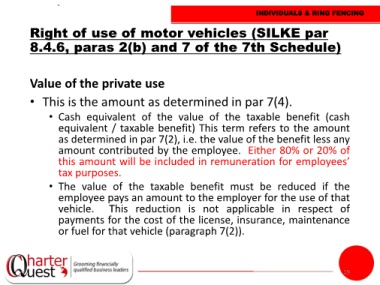

INDIVIDUALS & RING FENCING

Right of use of motor vehicles (SILKE par

8.4.6, paras 2(b) and 7 of the 7th Schedule)

Value of the private use

• This is the amount as determined in par 7(4).

• Cash equivalent of the value of the taxable benefit (cash

equivalent / taxable benefit) This term refers to the amount

as determined in par 7(2), i.e. the value of the benefit less any

amount contributed by the employee. Either 80% or 20% of

this amount will be included in remuneration for employees’

tax purposes.

• The value of the taxable benefit must be reduced if the

employee pays an amount to the employer for the use of that

vehicle. This reduction is not applicable in respect of

payments for the cost of the license, insurance, maintenance

or fuel for that vehicle (paragraph 7(2)).

19