Page 30 - Taxation Test 4 Slides - Individuals

P. 30

INDIVIDUALS & RING FENCING

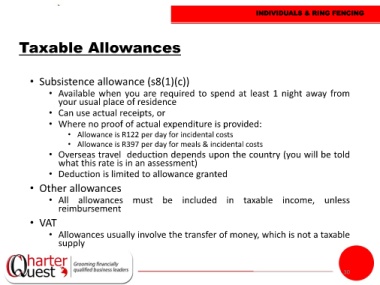

Taxable Allowances

• Subsistence allowance (s8(1)(c))

• Available when you are required to spend at least 1 night away from

your usual place of residence

• Can use actual receipts, or

• Where no proof of actual expenditure is provided:

• Allowance is R122 per day for incidental costs

• Allowance is R397 per day for meals & incidental costs

• Overseas travel deduction depends upon the country (you will be told

what this rate is in an assessment)

• Deduction is limited to allowance granted

• Other allowances

• All allowances must be included in taxable income, unless

reimbursement

• VAT

• Allowances usually involve the transfer of money, which is not a taxable

supply

30