Page 32 - Taxation Test 4 Slides - Individuals

P. 32

INDIVIDUALS & RING FENCING

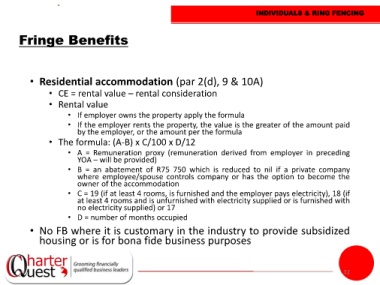

Fringe Benefits

• Residential accommodation (par 2(d), 9 & 10A)

• CE = rental value – rental consideration

• Rental value

• If employer owns the property apply the formula

• If the employer rents the property, the value is the greater of the amount paid

by the employer, or the amount per the formula

• The formula: (A-B) x C/100 x D/12

• A = Remuneration proxy (remuneration derived from employer in preceding

YOA – will be provided)

• B = an abatement of R75 750 which is reduced to nil if a private company

where employee/spouse controls company or has the option to become the

owner of the accommodation

• C = 19 (if at least 4 rooms, is furnished and the employer pays electricity), 18 (if

at least 4 rooms and is unfurnished with electricity supplied or is furnished with

no electricity supplied) or 17

• D = number of months occupied

• No FB where it is customary in the industry to provide subsidized

housing or is for bona fide business purposes

32