Page 60 - Taxation Test 4 Slides - Individuals

P. 60

INDIVIDUALS & RING FENCING

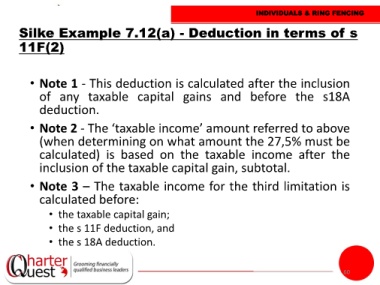

Silke Example 7.12(a) - Deduction in terms of s

11F(2)

• Note 1 - This deduction is calculated after the inclusion

of any taxable capital gains and before the s18A

deduction.

• Note 2 - The ‘taxable income’ amount referred to above

(when determining on what amount the 27,5% must be

calculated) is based on the taxable income after the

inclusion of the taxable capital gain, subtotal.

• Note 3 – The taxable income for the third limitation is

calculated before:

• the taxable capital gain;

• the s 11F deduction, and

• the s 18A deduction.

60