Page 64 - Taxation Test 4 Slides - Individuals

P. 64

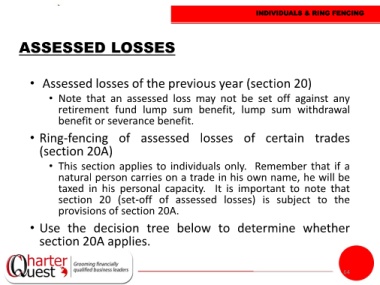

INDIVIDUALS & RING FENCING

ASSESSED LOSSES

• Assessed losses of the previous year (section 20)

• Note that an assessed loss may not be set off against any

retirement fund lump sum benefit, lump sum withdrawal

benefit or severance benefit.

• Ring-fencing of assessed losses of certain trades

(section 20A)

• This section applies to individuals only. Remember that if a

natural person carries on a trade in his own name, he will be

taxed in his personal capacity. It is important to note that

section 20 (set-off of assessed losses) is subject to the

provisions of section 20A.

• Use the decision tree below to determine whether

section 20A applies.

64