Page 46 - Taxation F6 - Income From Employment

P. 46

Income from Employment

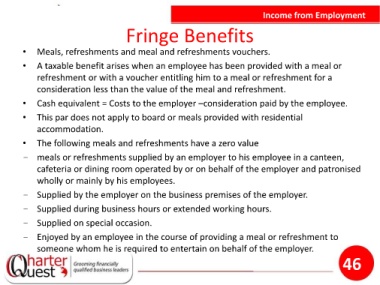

Fringe Benefits

• Meals, refreshments and meal and refreshments vouchers.

• A taxable benefit arises when an employee has been provided with a meal or

refreshment or with a voucher entitling him to a meal or refreshment for a

consideration less than the value of the meal and refreshment.

• Cash equivalent = Costs to the employer –consideration paid by the employee.

• This par does not apply to board or meals provided with residential

accommodation.

• The following meals and refreshments have a zero value

- meals or refreshments supplied by an employer to his employee in a canteen,

cafeteria or dining room operated by or on behalf of the employer and patronised

wholly or mainly by his employees.

- Supplied by the employer on the business premises of the employer.

- Supplied during business hours or extended working hours.

- Supplied on special occasion.

- Enjoyed by an employee in the course of providing a meal or refreshment to

someone whom he is required to entertain on behalf of the employer.

46