Page 7 - PowerPoint Presentation

P. 7

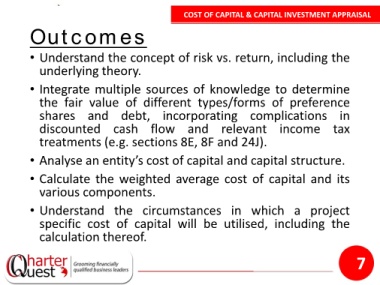

COST OF CAPITAL & CAPITAL INVESTMENT APPRAISAL

Outcomes

• Understand the concept of risk vs. return, including the

underlying theory.

• Integrate multiple sources of knowledge to determine

the fair value of different types/forms of preference

shares and debt, incorporating complications in

discounted cash flow and relevant income tax

treatments (e.g. sections 8E, 8F and 24J).

• Analyse an entity’s cost of capital and capital structure.

• Calculate the weighted average cost of capital and its

various components.

• Understand the circumstances in which a project

specific cost of capital will be utilised, including the

calculation thereof.

7