Page 8 - PowerPoint Presentation

P. 8

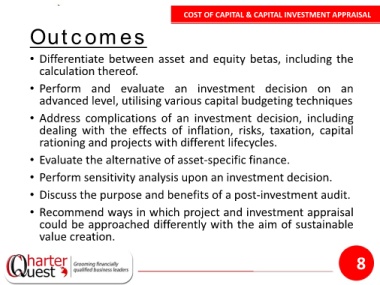

COST OF CAPITAL & CAPITAL INVESTMENT APPRAISAL

Outcomes

• Differentiate between asset and equity betas, including the

calculation thereof.

• Perform and evaluate an investment decision on an

advanced level, utilising various capital budgeting techniques

• Address complications of an investment decision, including

dealing with the effects of inflation, risks, taxation, capital

rationing and projects with different lifecycles.

• Evaluate the alternative of asset-specific finance.

• Perform sensitivity analysis upon an investment decision.

• Discuss the purpose and benefits of a post-investment audit.

• Recommend ways in which project and investment appraisal

could be approached differently with the aim of sustainable

value creation.

8