Page 21 - Trusts & International tax class slides

P. 21

TRUSTS

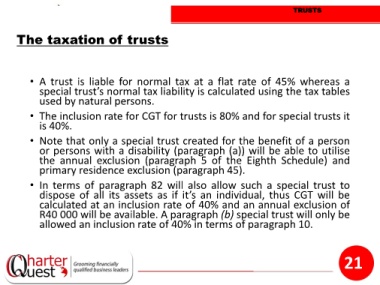

The taxation of trusts

• A trust is liable for normal tax at a flat rate of 45% whereas a

special trust’s normal tax liability is calculated using the tax tables

used by natural persons.

• The inclusion rate for CGT for trusts is 80% and for special trusts it

is 40%.

• Note that only a special trust created for the benefit of a person

or persons with a disability (paragraph (a)) will be able to utilise

the annual exclusion (paragraph 5 of the Eighth Schedule) and

primary residence exclusion (paragraph 45).

• In terms of paragraph 82 will also allow such a special trust to

dispose of all its assets as if it’s an individual, thus CGT will be

calculated at an inclusion rate of 40% and an annual exclusion of

R40 000 will be available. A paragraph (b) special trust will only be

allowed an inclusion rate of 40% in terms of paragraph 10.

21