Page 22 - Trusts & International tax class slides

P. 22

TRUSTS

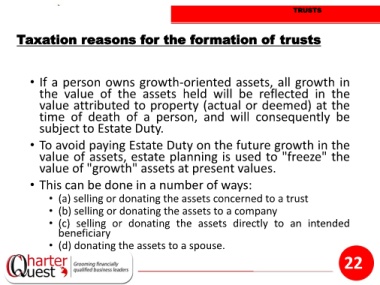

Taxation reasons for the formation of trusts

• If a person owns growth-oriented assets, all growth in

the value of the assets held will be reflected in the

value attributed to property (actual or deemed) at the

time of death of a person, and will consequently be

subject to Estate Duty.

• To avoid paying Estate Duty on the future growth in the

value of assets, estate planning is used to "freeze" the

value of "growth" assets at present values.

• This can be done in a number of ways:

• (a) selling or donating the assets concerned to a trust

• (b) selling or donating the assets to a company

• (c) selling or donating the assets directly to an intended

beneficiary

• (d) donating the assets to a spouse.

22