Page 43 - Trusts & International tax class slides

P. 43

TRUSTS

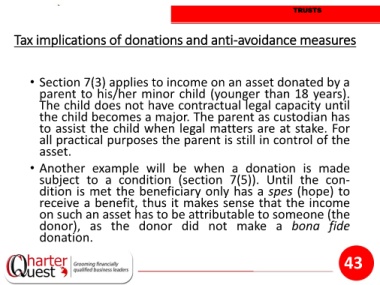

Tax implications of donations and anti-avoidance measures

• Section 7(3) applies to income on an asset donated by a

parent to his/her minor child (younger than 18 years).

The child does not have contractual legal capacity until

the child becomes a major. The parent as custodian has

to assist the child when legal matters are at stake. For

all practical purposes the parent is still in control of the

asset.

• Another example will be when a donation is made

subject to a condition (section 7(5)). Until the con-

dition is met the beneficiary only has a spes (hope) to

receive a benefit, thus it makes sense that the income

on such an asset has to be attributable to someone (the

donor), as the donor did not make a bona fide

donation.

43