Page 44 - Trusts & International tax class slides

P. 44

TRUSTS

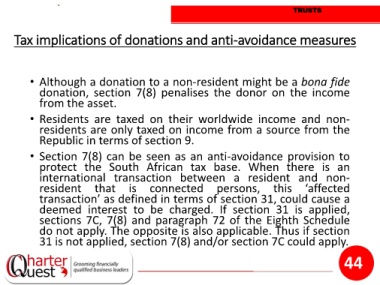

Tax implications of donations and anti-avoidance measures

• Although a donation to a non-resident might be a bona fide

donation, section 7(8) penalises the donor on the income

from the asset.

• Residents are taxed on their worldwide income and non-

residents are only taxed on income from a source from the

Republic in terms of section 9.

• Section 7(8) can be seen as an anti-avoidance provision to

protect the South African tax base. When there is an

international transaction between a resident and non-

resident that is connected persons, this ‘affected

transaction’ as defined in terms of section 31, could cause a

deemed interest to be charged. If section 31 is applied,

sections 7C, 7(8) and paragraph 72 of the Eighth Schedule

do not apply. The opposite is also applicable. Thus if section

31 is not applied, section 7(8) and/or section 7C could apply.

44