Page 74 - Trusts & International tax class slides

P. 74

TRUSTS

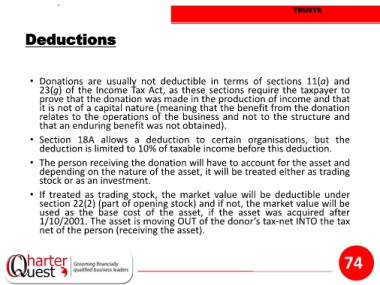

Deductions

• Donations are usually not deductible in terms of sections 11(a) and

23(g) of the Income Tax Act, as these sections require the taxpayer to

prove that the donation was made in the production of income and that

it is not of a capital nature (meaning that the benefit from the donation

relates to the operations of the business and not to the structure and

that an enduring benefit was not obtained).

• Section 18A allows a deduction to certain organisations, but the

deduction is limited to 10% of taxable income before this deduction.

• The person receiving the donation will have to account for the asset and

depending on the nature of the asset, it will be treated either as trading

stock or as an investment.

• If treated as trading stock, the market value will be deductible under

section 22(2) (part of opening stock) and if not, the market value will be

used as the base cost of the asset, if the asset was acquired after

1/10/2001. The asset is moving OUT of the donor’s tax-net INTO the tax

net of the person (receiving the asset).

74