Page 79 - Trusts & International tax class slides

P. 79

TRUSTS

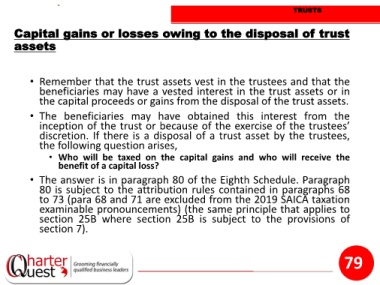

Capital gains or losses owing to the disposal of trust

assets

• Remember that the trust assets vest in the trustees and that the

beneficiaries may have a vested interest in the trust assets or in

the capital proceeds or gains from the disposal of the trust assets.

• The beneficiaries may have obtained this interest from the

inception of the trust or because of the exercise of the trustees’

discretion. If there is a disposal of a trust asset by the trustees,

the following question arises,

• Who will be taxed on the capital gains and who will receive the

benefit of a capital loss?

• The answer is in paragraph 80 of the Eighth Schedule. Paragraph

80 is subject to the attribution rules contained in paragraphs 68

to 73 (para 68 and 71 are excluded from the 2019 SAICA taxation

examinable pronouncements) (the same principle that applies to

section 25B where section 25B is subject to the provisions of

section 7).

79