Page 19 - Finac1 Test 1 slides - 5. Income Taxes (IAS 12)

P. 19

INCOME TAXES

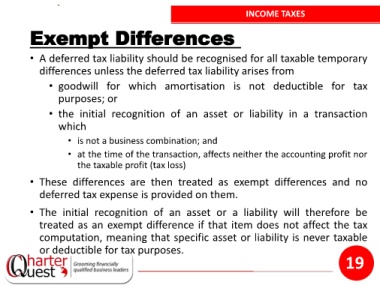

Exempt Differences

• A deferred tax liability should be recognised for all taxable temporary

differences unless the deferred tax liability arises from

• goodwill for which amortisation is not deductible for tax

purposes; or

• the initial recognition of an asset or liability in a transaction

which

• is not a business combination; and

• at the time of the transaction, affects neither the accounting profit nor

the taxable profit (tax loss)

• These differences are then treated as exempt differences and no

deferred tax expense is provided on them.

• The initial recognition of an asset or a liability will therefore be

treated as an exempt difference if that item does not affect the tax

computation, meaning that specific asset or liability is never taxable

or deductible for tax purposes.

19