Page 21 - Finac1 Test 1 slides - 5. Income Taxes (IAS 12)

P. 21

INCOME TAXES

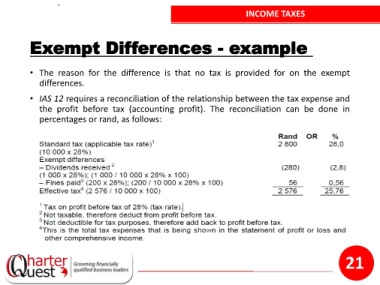

Exempt Differences - example

• The reason for the difference is that no tax is provided for on the exempt

differences.

• IAS 12 requires a reconciliation of the relationship between the tax expense and

the profit before tax (accounting profit). The reconciliation can be done in

percentages or rand, as follows:

21