Page 49 - Finac1 Test 1 slides - 5. Income Taxes (IAS 12)

P. 49

INCOME TAXES

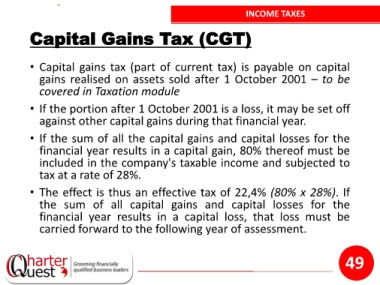

Capital Gains Tax (CGT)

• Capital gains tax (part of current tax) is payable on capital

gains realised on assets sold after 1 October 2001 – to be

covered in Taxation module

• If the portion after 1 October 2001 is a loss, it may be set off

against other capital gains during that financial year.

• If the sum of all the capital gains and capital losses for the

financial year results in a capital gain, 80% thereof must be

included in the company's taxable income and subjected to

tax at a rate of 28%.

• The effect is thus an effective tax of 22,4% (80% x 28%). If

the sum of all capital gains and capital losses for the

financial year results in a capital loss, that loss must be

carried forward to the following year of assessment.

49