Page 52 - Finac1 Test 1 slides - 5. Income Taxes (IAS 12)

P. 52

INCOME TAXES

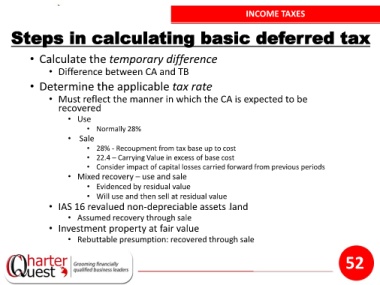

Steps in calculating basic deferred tax

• Calculate the temporary difference

• Difference between CA and TB

• Determine the applicable tax rate

• Must reflect the manner in which the CA is expected to be

recovered

• Use

• Normally 28%

• Sale

• 28% - Recoupment from tax base up to cost

• 22.4 – Carrying Value in excess of base cost

• Consider impact of capital losses carried forward from previous periods

• Mixed recovery – use and sale

• Evidenced by residual value

• Will use and then sell at residual value

• IAS 16 revalued non-depreciable assets land

• Assumed recovery through sale

• Investment property at fair value

• Rebuttable presumption: recovered through sale

52