Page 10 - F6 - Capital Allowances - Movable & Immovable Assets

P. 10

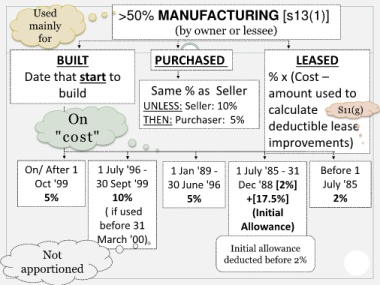

Used >50% MANUFACTURING [s13(1)]

mainly (by owner or lessee)

for

BUILT PURCHASED LEASED

Date that start to % x (Cost –

build Same % as Seller amount used to

UNLESS: Seller: 10% calculate S11(g)

On THEN: Purchaser: 5% deductible lease

"cost" improvements)

On/ After 1 1 July '96 - 1 Jan '89 - 1 July '85 - 31 Before 1

Oct '99 30 Sept '99 30 June '96 Dec '88 [2%] July '85

5% 10% 5% +[17.5%] 2%

( if used (Initial

before 31 Allowance)

March '00)

Initial allowance

Not deducted before 2%

apportioned