Page 6 - F6 - Capital Allowances - Movable & Immovable Assets

P. 6

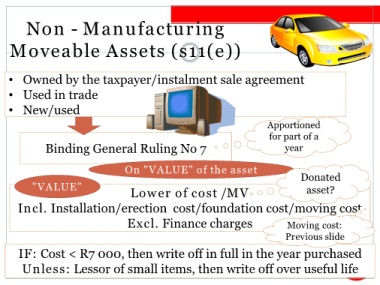

Non - Manufacturing

Moveable Assets (s11(e))

• Owned by the taxpayer/instalment sale agreement

• Used in trade

• New/used

Apportioned

for part of a

Binding General Ruling No 7 year

On "VALUE" of the asset

Donated

"VALUE"

Lower of cost /MV asset?

Incl. Installation/erection cost/foundation cost/moving cost

Excl. Finance charges Moving cost:

Previous slide

IF: Cost < R7 000, then write off in full in the year purchased

Unless: Lessor of small items, then write off over useful life