Page 19 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 19

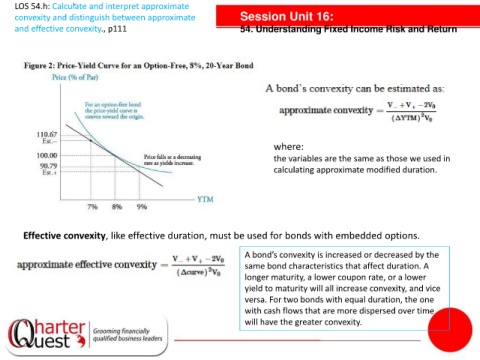

LOS 54.h: Calculate and interpret approximate

convexity and distinguish between approximate Session Unit 16:

and effective convexity., p111 54. Understanding Fixed Income Risk and Return

tanties

where:

the variables are the same as those we used in

calculating approximate modified duration.

Effective convexity, like effective duration, must be used for bonds with embedded options.

A bond’s convexity is increased or decreased by the

same bond characteristics that affect duration. A

longer maturity, a lower coupon rate, or a lower

yield to maturity will all increase convexity, and vice

versa. For two bonds with equal duration, the one

with cash flows that are more dispersed over time

will have the greater convexity.