Page 21 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 21

Session Unit 16:

54. Understanding Fixed Income Risk and Return

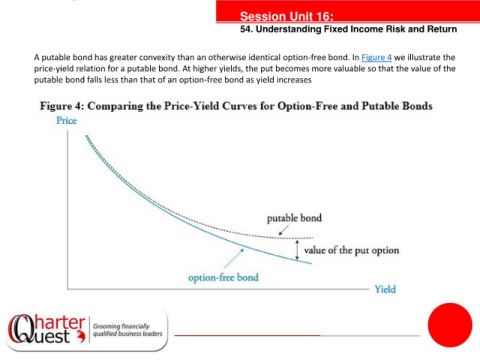

A putable bond has greater convexity than an otherwise identical option-free bond. In Figure 4 we illustrate the

price-yield relation for a putable bond. At higher yields, the put becomes more valuable so that the value of the

putable bond falls less than that of an option-free bond as yield increases

tanties