Page 25 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 25

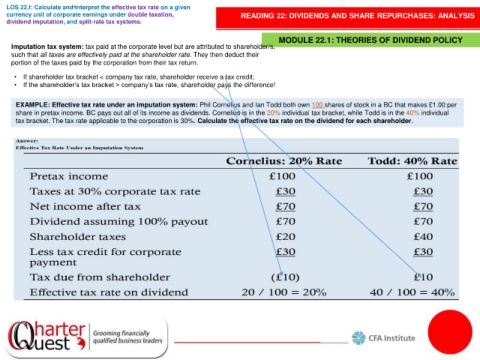

LOS 22.f: Calculate and interpret the effective tax rate on a given

currency unit of corporate earnings under double taxation, READING 22: DIVIDENDS AND SHARE REPURCHASES: ANALYSIS

dividend imputation, and split-rate tax systems.

MODULE 22.1: THEORIES OF DIVIDEND POLICY

Imputation tax system: tax paid at the corporate level but are attributed to shareholder/s,

such that all taxes are effectively paid at the shareholder rate. They then deduct their

portion of the taxes paid by the corporation from their tax return.

• If shareholder tax bracket < company tax rate, shareholder receive a tax credit;

• If the shareholder’s tax bracket > company’s tax rate, shareholder pays the difference!

EXAMPLE: Effective tax rate under an imputation system: Phil Cornelius and Ian Todd both own 100 shares of stock in a BC that makes £1.00 per

share in pretax income. BC pays out all of its income as dividends. Cornelius is in the 20% individual tax bracket, while Todd is in the 40% individual

tax bracket. The tax rate applicable to the corporation is 30%. Calculate the effective tax rate on the dividend for each shareholder.