Page 26 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 26

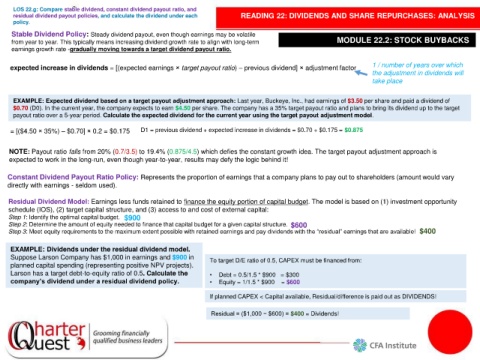

LOS 22.g: Compare stable dividend, constant dividend payout ratio, and

residual dividend payout policies, and calculate the dividend under each READING 22: DIVIDENDS AND SHARE REPURCHASES: ANALYSIS

policy.

Stable Dividend Policy: Steady dividend payout, even though earnings may be volatile

from year to year. This typically means increasing dividend growth rate to align with long-term MODULE 22.2: STOCK BUYBACKS

earnings growth rate -gradually moving towards a target dividend payout ratio.

expected increase in dividends = [(expected earnings × target payout ratio) – previous dividend] × adjustment factor 1 / number of years over which

the adjustment in dividends will

take place

EXAMPLE: Expected dividend based on a target payout adjustment approach: Last year, Buckeye, Inc., had earnings of $3.50 per share and paid a dividend of

$0.70 (D0). In the current year, the company expects to earn $4.50 per share. The company has a 35% target payout ratio and plans to bring its dividend up to the target

payout ratio over a 5-year period. Calculate the expected dividend for the current year using the target payout adjustment model.

= [($4.50 × 35%) – $0.70] × 0.2 = $0.175 D1 = previous dividend + expected increase in dividends = $0.70 + $0.175 = $0.875

NOTE: Payout ratio falls from 20% (0.7/3.5) to 19.4% (0.875/4.5) which defies the constant growth idea. The target payout adjustment approach is

expected to work in the long-run, even though year-to-year, results may defy the logic behind it!

Constant Dividend Payout Ratio Policy: Represents the proportion of earnings that a company plans to pay out to shareholders (amount would vary

directly with earnings - seldom used).

Residual Dividend Model: Earnings less funds retained to finance the equity portion of capital budget. The model is based on (1) investment opportunity

schedule (IOS), (2) target capital structure, and (3) access to and cost of external capital:

Step 1: Identify the optimal capital budget. $900

Step 2: Determine the amount of equity needed to finance that capital budget for a given capital structure. $600

Step 3: Meet equity requirements to the maximum extent possible with retained earnings and pay dividends with the “residual” earnings that are available! $400

EXAMPLE: Dividends under the residual dividend model.

Suppose Larson Company has $1,000 in earnings and $900 in To target D/E ratio of 0.5, CAPEX must be financed from:

planned capital spending (representing positive NPV projects).

Larson has a target debt-to-equity ratio of 0.5. Calculate the • Debt = 0.5/1.5 * $900 = $300

company’s dividend under a residual dividend policy. • Equity = 1/1.5 * $900 = $600

If planned CAPEX < Capital available, Residual/difference is paid out as DIVIDENDS!

Residual = ($1,000 − $600) = $400 = Dividends!