Page 525 - FM Integrated WorkBook STUDENT 2018-19

P. 525

Answers

Chapter 18

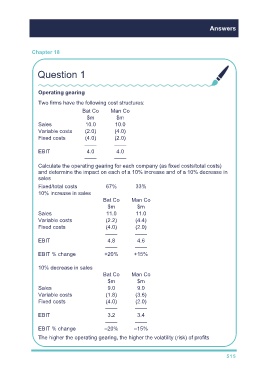

Question 1

Operating gearing

Two firms have the following cost structures:

Bat Co Man Co

$m $m

Sales 10.0 10.0

Variable costs (2.0) (4.0)

Fixed costs (4.0) (2.0)

–––– ––––

EBIT 4.0 4.0

–––– ––––

Calculate the operating gearing for each company (as fixed costs/total costs)

and determine the impact on each of a 10% increase and of a 10% decrease in

sales

Fixed/total costs 67% 33%

10% increase in sales

Bat Co Man Co

$m $m

Sales 11.0 11.0

Variable costs (2.2) (4.4)

Fixed costs (4.0) (2.0)

–––– ––––

EBIT 4.8 4.6

–––– ––––

EBIT % change +20% +15%

10% decrease in sales

Bat Co Man Co

$m $m

Sales 9.0 9.0

Variable costs (1.8) (3.6)

Fixed costs (4.0) (2.0)

–––– ––––

EBIT 3.2 3.4

–––– ––––

EBIT % change –20% –15%

The higher the operating gearing, the higher the volatility (risk) of profits

515