Page 527 - FM Integrated WorkBook STUDENT 2018-19

P. 527

Answers

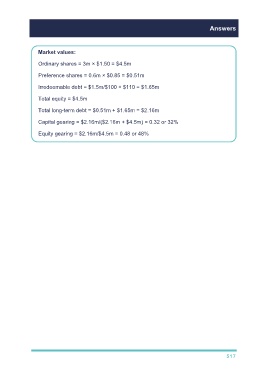

Market values:

Ordinary shares = 3m × $1.50 = $4.5m

Preference shares = 0.6m × $0.85 = $0.51m

Irredeemable debt = $1.5m/$100 × $110 = $1.65m

Total equity = $4.5m

Total long-term debt = $0.51m + $1.65m = $2.16m

Capital gearing = $2.16m/($2.16m + $4.5m) = 0.32 or 32%

Equity gearing = $2.16m/$4.5m = 0.48 or 48%

517