Page 532 - FM Integrated WorkBook STUDENT 2018-19

P. 532

Chapter 21

Chapter 19

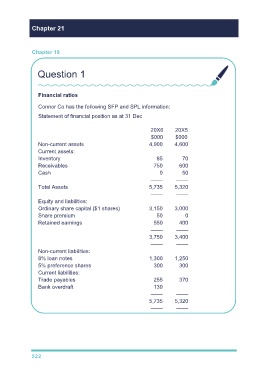

Question 1

Financial ratios

Connor Co has the following SFP and SPL information:

Statement of financial position as at 31 Dec

20X6 20X5

$000 $000

Non-current assets 4,900 4,600

Current assets:

Inventory 85 70

Receivables 750 600

Cash 0 50

–––– ––––

Total Assets 5,735 5,320

–––– ––––

Equity and liabilities:

Ordinary share capital ($1 shares) 3,150 3,000

Share premium 50 0

Retained earnings 550 400

–––– ––––

3,750 3,400

–––– ––––

Non-current liabilities:

8% loan notes 1,300 1,250

5% preference shares 300 300

Current liabilities:

Trade payables 255 370

Bank overdraft 130

–––– ––––

5,735 5,320

–––– ––––

522