Page 537 - FM Integrated WorkBook STUDENT 2018-19

P. 537

Answers

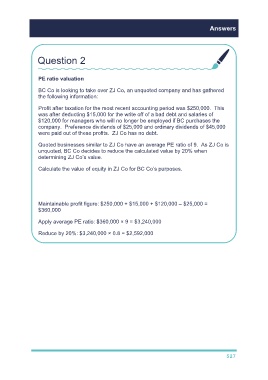

Question 2

PE ratio valuation

BC Co is looking to take over ZJ Co, an unquoted company and has gathered

the following information:

Profit after taxation for the most recent accounting period was $250,000. This

was after deducting $15,000 for the write off of a bad debt and salaries of

$120,000 for managers who will no longer be employed if BC purchases the

company. Preference dividends of $25,000 and ordinary dividends of $45,000

were paid out of these profits. ZJ Co has no debt.

Quoted businesses similar to ZJ Co have an average PE ratio of 9. As ZJ Co is

unquoted, BC Co decides to reduce the calculated value by 20% when

determining ZJ Co’s value.

Calculate the value of equity in ZJ Co for BC Co’s purposes.

Maintainable profit figure: $250,000 + $15,000 + $120,000 – $25,000 =

$360,000

Apply average PE ratio: $360,000 × 9 = $3,240,000

Reduce by 20%: $3,240,000 × 0.8 = $2,592,000

527