Page 79 - FM Integrated WorkBook STUDENT 2018-19

P. 79

Investment appraisal – Further aspects of discounted cash flows

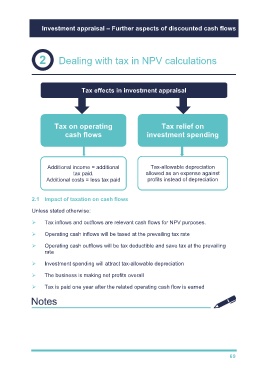

Dealing with tax in NPV calculations

Tax effects in investment appraisal

Tax on operating Tax relief on

cash flows investment spending

Additional income = additional Tax-allowable depreciation

tax paid. allowed as an expense against

Additional costs = less tax paid profits instead of depreciation

2.1 Impact of taxation on cash flows

Unless stated otherwise:

Tax inflows and outflows are relevant cash flows for NPV purposes.

Operating cash inflows will be taxed at the prevailing tax rate

Operating cash outflows will be tax deductible and save tax at the prevailing

rate

Investment spending will attract tax-allowable depreciation

The business is making net profits overall

Tax is paid one year after the related operating cash flow is earned

69