Page 78 - Gross Income class slides

P. 78

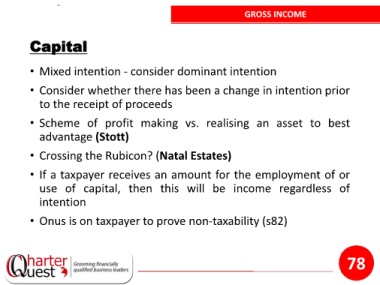

GROSS INCOME

Capital

• Mixed intention - consider dominant intention

• Consider whether there has been a change in intention prior

to the receipt of proceeds

• Scheme of profit making vs. realising an asset to best

advantage (Stott)

• Crossing the Rubicon? (Natal Estates)

• If a taxpayer receives an amount for the employment of or

use of capital, then this will be income regardless of

intention

• Onus is on taxpayer to prove non-taxability (s82)

78