Page 79 - Gross Income class slides

P. 79

GROSS INCOME

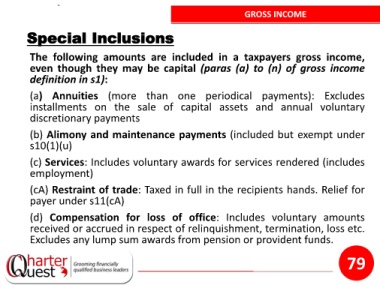

Special Inclusions

The following amounts are included in a taxpayers gross income,

even though they may be capital (paras (a) to (n) of gross income

definition in s1):

(a) Annuities (more than one periodical payments): Excludes

installments on the sale of capital assets and annual voluntary

discretionary payments

(b) Alimony and maintenance payments (included but exempt under

s10(1)(u)

(c) Services: Includes voluntary awards for services rendered (includes

employment)

(cA) Restraint of trade: Taxed in full in the recipients hands. Relief for

payer under s11(cA)

(d) Compensation for loss of office: Includes voluntary amounts

received or accrued in respect of relinquishment, termination, loss etc.

Excludes any lump sum awards from pension or provident funds.

79